|crypto, knowledgehub

Bitcoin Halving 2024: The Next Big Event in Crypto

Every four years, like clockwork, Bitcoin undergoes an event known as a halving that cuts its mining reward in half. As the next Bitcoin halving 2024 approaches, let's take a look back at Bitcoin's history with these events and what we might expect this time around!

The Bitcoin network was designed by its mysterious creator, Satoshi Nakamoto, to have a fixed supply of 21 million coins, with half of them to be mined by around the year 2140.

To ensure the supply increases at a slowing rate, the rewards miners receive for validating transactions and adding new blocks to the blockchain are cut in half approximately every four years.

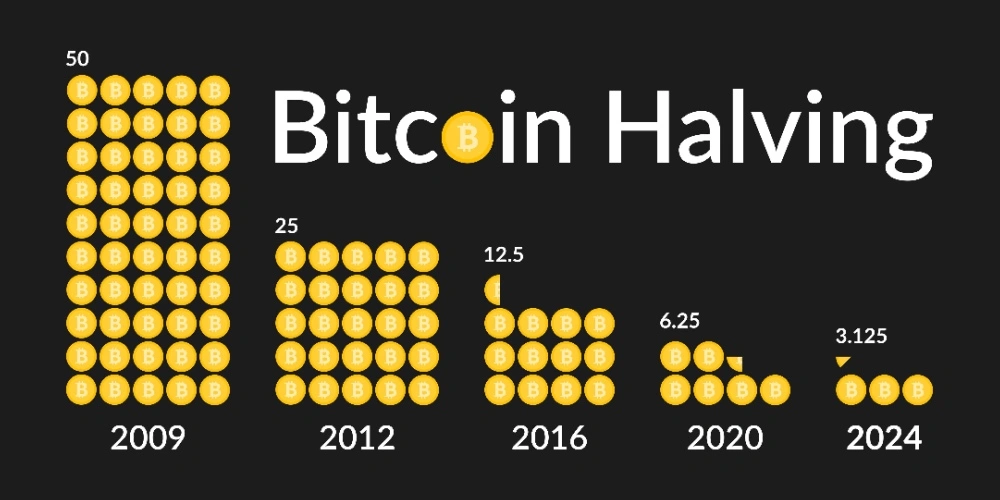

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 BTC to 25. They cut it again in July 2016, this time from 25 to 12.5 BTC. Most recently, in May 2020, it fell to the current level of 6.25 BTC.

Join us in this blog as we explore the key details of Bitcoin halving from its halving cycle to economic significance of it. Let’s start by understanding why Bitcoin halves!

Why does Bitcoin halve?

Satoshi built halvings directly into Bitcoin's code as an integral part of its supply schedule. By creating predictable decreases in crypto mining rewards over time, it helps maintain the cryptocurrency's balance of incentive and scarcity.

With each Bitcoin halving, miners earn half as many new crypto coins for doing the same amount of work securing the network. This slower inflation rate ensures Bitcoin behaves more like a commodity with a fixed supply over the long run.

It also prevents the network from becoming oversaturated with new coins entering circulation too quickly, which could destabilize prices.

The Bitcoin halving cycle

Most analysts agree the roughly four-year halving cycle has significantly influenced Bitcoin's price movements so far. In the 1-2 years following previous halvings, BTC has seen spectacular crypto bull runs, with new all-time highs set each time.

This pattern seems to align with the reduction in new coin supply hitting the market. With mining revenue cut in half, miners require a higher Bitcoin price just to maintain profitability.

This reduced selling pressure from miners cashing out coincides with heightened media attention around the Bitcoin halving. All of these factors together tend to spark fresh waves of investor interest and demand for Bitcoin. You can check out “Bull or Bear Market” to understand this cycle better.

What happened the last time Bitcoin halved?

The most recent Bitcoin halving occurred on May 11th, 2020, reducing the block reward from 12.5 to 6.25 BTC. In the 18 months that followed, Bitcoin saw extraordinary gains, unlike anything prior.

The emerging COVID-19 pandemic caused economic uncertainty, but BTC surged over 750% to set a new record high of $67,000 in November 2021.

This mega crypto bull run validated theories that halvings stimulate multi-year price cycles in Bitcoin. Each four years, a new cohort of investors is introduced who may not be as familiar with the signature event and its historical impact.

Is Bitcoin halving good or bad?

Most analysts view Bitcoin halving positively overall for several reasons. On the supply side, it ensures steady inflation control through predictable issuance reductions.

Halvings also put buying pressure on BTC by challenging miners' profitability. And the attention they draw to Bitcoin tends to expand its user base each cycle.

However, skeptics worry that reduced mining incentives could threaten the security of the network if they dissuade certain players. There is also no guarantee that the halving cycle will continue stimulating bull markets forever. Unexpected geopolitical or economic developments could dampen the effects.

Is Bitcoin halving in 2024?

Indeed, the internal algorithm of Bitcoin estimates the next halving to happen in early April 2024. Exact block height predictions vary slightly depending on minor adjustments to the mining difficulty over time.

However, the community generally anticipates a drop in block rewards from the current 6.25 BTC to 3.125 BTC per mined block sometime in the second week of April 2024. This will represent the fourth decrease in Bitcoin's overall planned issuance rate since the mining of its genesis block.

When is the next Bitcoin halving?

As previously mentioned, experts estimate that the next Bitcoin halving will take place around April 2024, reducing block rewards from the current 6.25 BTC to 3.125 BTC. More specifically, based on its 4-year emission-halving schedule:

- November 28, 2012: 1st halving from 50 to 25 BTC per block

- July 9, 2016: 2nd halving from 25 to 12.5 BTC per block

- May 11, 2020: 3rd halving from 12.5 to 6.25 BTC per block

- Estimated April 2024: 4th halving from 6.25 to 3.125 BTC per block

Bitcoin halvings: key events

Let's recap some of the major events associated with previous Bitcoin halvings:

- 2012: Price rose from $13 to $1,152 within a year after the first Bitcoin halving.

- 2016: Price jumped from $664 at halving to $17,760 peak, kickstarting the crypto bull run.

- 2020: Amidst the COVID crisis, BTC surged over 750% to a then-record $67,000 by November 2021.

- 2024: Will mining subsidies be reduced from 6.25 to 3.125 BTC? This is already fueling bullish speculation.

Each Bitcoin halving cycle has been linked with renewed media attention and amplified 'buy the rumor, sell the news' investor rotation volume buyhold behavior.

Technological significance of the Bitcoin halving 2024

From a technical standpoint, halvings play several important roles in maintaining Bitcoin as a decentralized digital currency:

- They ensure a predictable reduction in new coin supply at a steady inflation rate to mimic the scarcity of hard assets.

- Reduced crypto mining rewards require higher Bitcoin prices to maintain network security via sufficient investment in hardware and resources.

- Each halving effectively cuts the inflation rate in half on an ongoing basis to keep Bitcoin deflationary long-term.

- It strengthens the resilience of the distributed consensus protocol by challenging miners' operating costs every 4 years.

Economic significance of the Bitcoin halving 2024

From an economic perspective, Bitcoin halvings aim to:

- Gradually slow Bitcoin's emission schedule as per its internal code, preventing unstable or hyperinflationary supply dynamics.

- Motivate buying pressure on BTC from institutional players seeking a hedge against inflation, which major central banks show little sign of controlling.

- Alter market incentives by reducing the number of coins miners can dump, easing downside selling pressure during bull phases.

- Spark renewed media coverage and awareness of Bitcoin each cycle to recruit fresh cohorts of investors and users to the network.

- If history repeats itself, the 2024 event could strengthen Bitcoin's role as a non-sovereign store of value and inflation hedge.

Impact of the halving cycle on Bitcoin’s price

As we've discussed, there's a clear pattern so far showing Bitcoin tends to enjoy spectacular crypto bull runs in the 1-2 years following each halving:

- 2012-2013: Price up over 800x from halving to peak

- 2015-2017: Up over 27x

- 2019-2021: Up over 5x

This bullish price action seems tied to dropping mining supply, reducing selling pressure amidst renewed hype cycles. Lower inflation also strengthens Bitcoin's appeal as a scarce asset.

While past performance doesn't guarantee future results, supply-demand dynamics suggest the Bitcoin halving 2024 could again drive BTC to new heights, perhaps surpassing its November 2021 record peak.

The impact of a Bitcoin halving on miners

If difficulty and prices stay the same, a Bitcoin halving instantly reduces miners' revenue by half. In response, some inefficient operations may become unprofitable, leading miners to shut down their equipment.

This lowers Bitcoin's hash rate globally in the short run. However, as the price often rises due to greater scarcity in the future, network security increases. Furthermore, more high-powered miners join to take advantage of elevated rewards.

What is the reward for Bitcoin mining after 2024?

After the impending 2024 reduction, miners will receive 3.125 BTC per block instead of the current 6.25 BTC. This sets a new lower ceiling for mining rewards going forward until approximately May 2028, at which point the next Bitcoin halving would slice them in half again, most likely down to 1.5625 BTC.

In subsequent decades, rewards will continue to be cut periodically every 4 years until the total crypto market cap of 21 million BTC has been mined, likely around the year 2140.

How to trade Bitcoin halving?

While individual miners may face declining revenue, many traders view the Bitcoin halving 2024 as a prime buying opportunity. There are two main ways investors can participate in the event through financial products:

- Buying Bitcoin itself or crypto trading derivatives. You can check out “Crypto derivatives” and “Crypto derivative trading” to learn more about this concept.

- Buying actual BTC exposes one directly to price volatility, requiring secure storage.

The predictable reduction of Bitcoin's emission rate has occurred like clockwork through three previous halvings. As such, many consider the coming 2024 supply cut almost a certainty, barring changes to the underlying protocol.

History strongly suggests the ensuing months could witness impressive bullish price moves, assuming demand for Bitcoin remains robust in the face of the diminished availability of new coins. Cryptobunq, with its diverse suite of regulated crypto services, makes participation straightforward for all.

Crypto service providers like Cryptobunq make participating in the next crypto bull run easier than ever for risk-averse investors by offering regulated, insured crypto investment products.

Cyrptobunq is a one-stop shop crypto service provider that you can rely on for your various crypto needs, such as crypto checkout and invoicing, batch crypto payments, crypto exchange API, tokenization, custody and wallet, and more.

While exciting times are ahead, it is better to be partnered with a secure service provider that you can trust and benefit your projects for the better. Make sure to check out our case studies to learn more about CBQ solutions and expertise, and contact us today!